One of my colleagues was talking today about their mortgage. They have a mortgage of approx. $600,000 on a house worth ~$1MM in Ottawa that is coming up for renewal in the next ~8 months. (at that point he will have 20 yrs left of a 25 years amort.)

He’s been paying 3.34% interest rate and their monthly outlay is $2,945 monthly or $35,340 annually.

If he could renew right now without penalty, his current options would be in the range of 5.34% which would amount to $3,607 monthly or $43,284 annually. This would result in ~$8,000+ in additional annual expenses, or $40,000 over the next five years.

Even worse, if the rates continue to rise as they are expected to do so, he may be presented with a much less favorable option. Should that be in the range of 7.34%, his annual mortgage expenses will balloon to $51,948 annually, which is a whopping ~$16,000+in annual expenses; or $80,000 over the next five years.

Neither option is affordable to him; he’s essentially going to become “house poor”. This is the reality of purchasing the absolute biggest home that he could afford at the time when interest rates were at all-time lows.

If you have mortgage renewals coming up, make sure that you are proactive in assessing their impact on your financials. We’re beginning to snap back to reality and a lot of people are going to be faced with sobering new financial situations. Best prepare yourself for what that means and ensure that you have a plan as to how to best address your new monthly costs.

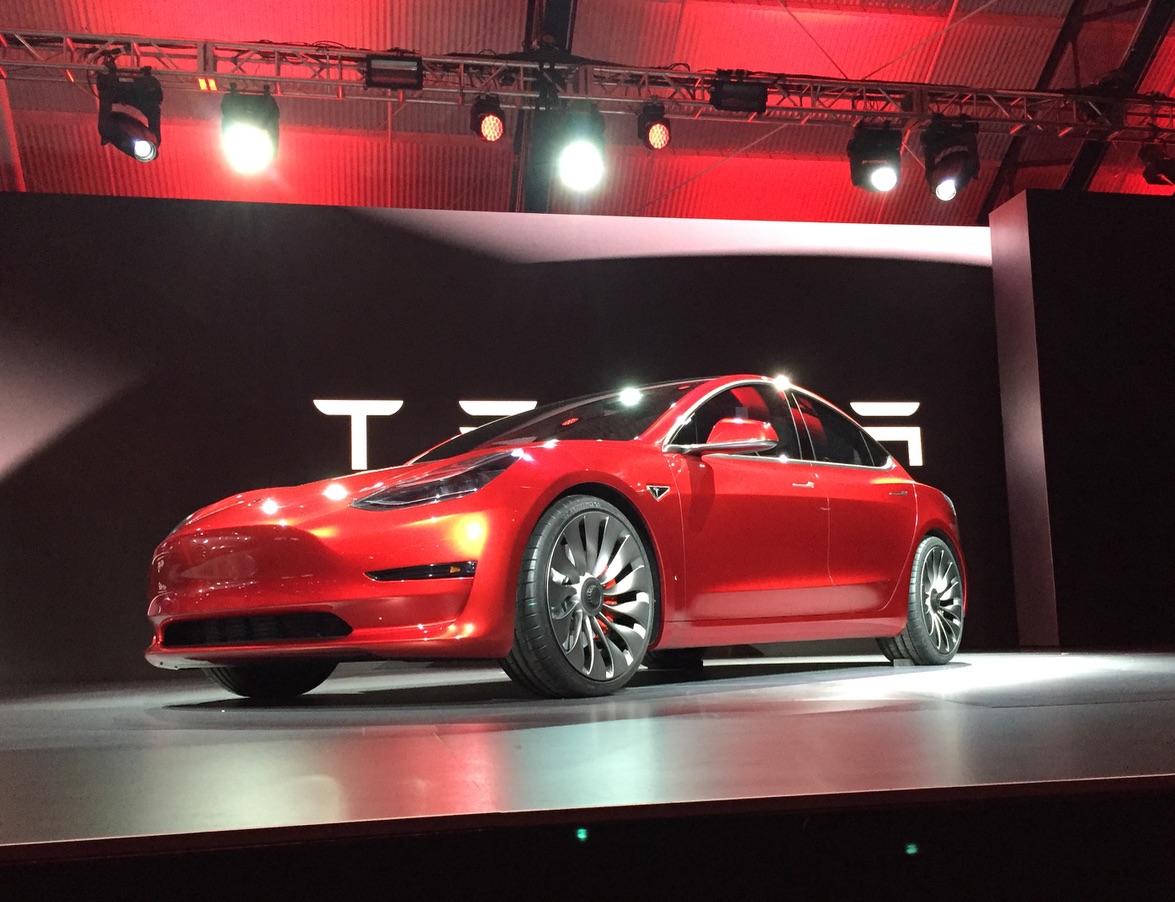

The new Tesla Model 3 is only $35K? That’s at least what their advertising would like you to believe. It’s only a “bit more” expensive than your last vehicle purchase. Maybe it’s finally time to get on that; you’ll save so much money on gas too!

The new Tesla Model 3 is only $35K? That’s at least what their advertising would like you to believe. It’s only a “bit more” expensive than your last vehicle purchase. Maybe it’s finally time to get on that; you’ll save so much money on gas too! In 2015, we purchased this luxury 6-plex for $960K with indoor parking, central air, four 3 bedrooms/2 bathroom units and two 1 bedroom 1 bathroom units. Each year we’ve been close to cashflow neutral, earning absolutely no monies from positive cashflow. Many of my startup students ask in bewilderment, “Why bother?”

In 2015, we purchased this luxury 6-plex for $960K with indoor parking, central air, four 3 bedrooms/2 bathroom units and two 1 bedroom 1 bathroom units. Each year we’ve been close to cashflow neutral, earning absolutely no monies from positive cashflow. Many of my startup students ask in bewilderment, “Why bother?” Last year, my friend bought a cottage for $180K. His down payment was 25%, or $45K. This year he boasted to me that he had made $18K in a year off the cottage. It was recently appraised at $195K (+$15K equity) and he rented it out a few times this summer to earn $3K in additional cashflow. Not a bad return right? $18K total. If only it was true…

Last year, my friend bought a cottage for $180K. His down payment was 25%, or $45K. This year he boasted to me that he had made $18K in a year off the cottage. It was recently appraised at $195K (+$15K equity) and he rented it out a few times this summer to earn $3K in additional cashflow. Not a bad return right? $18K total. If only it was true… Last night I met with a colleague of mine who said she didn’t have any money to invest in her retirement. As it turns out, within five minutes I found several instances where she was believing her own lies. The biggest one? Her car costs as much as her mortgage… that’s nuts!

Last night I met with a colleague of mine who said she didn’t have any money to invest in her retirement. As it turns out, within five minutes I found several instances where she was believing her own lies. The biggest one? Her car costs as much as her mortgage… that’s nuts!