People are so busy in their daily lives that they don’t give themselves the time to see anything that falls outside of their routines and habits. Unfortunately, as a result, most people never achieve peak happiness. Take the time to do one of the favorite exercises that I do with my students :

– What makes you happy?

– What keeps you from doing these things?

More often than not, the first one revolves around family and friends. New experiences, travel, social gatherings and games are typically involved the descriptions.

While experiences often mentioned require some money in order to experience, they typically don’t require amassing possessions, which is most often what keeps people from doing these things. They’re often neck-deep in work so that they can pay for their amassing of bigger, better, upgraded possessions; most of which they don’t use nearly enough to ever break even on.

When I remove these individuals from their daily lives to see what they’re doing, it’s always so crystal clear to them. You see, humans tend to get into routines and develop habits. We just keep doing the same thing over and over again, even if it never helps us to, and even pushes us even further away from, achieving peak happiness. Nearly everyone keeps themselves so occupied that we don’t even give ourselves time to think about what makes us happy.

If someone finds themselves in this boat, they should block off time each week to remove themselves from their daily lives so that they can sit down, relax and just think about what makes them happy and what gets in their way. This will lead to a plan as to how to achieve more happiness while eliminating the obstacles.

Removing ourselves from our daily lives is a gift that everyone should give themselves regularly – a few hours each week and a few weeks each year – the return on happiness from doing so will be immeasurable.

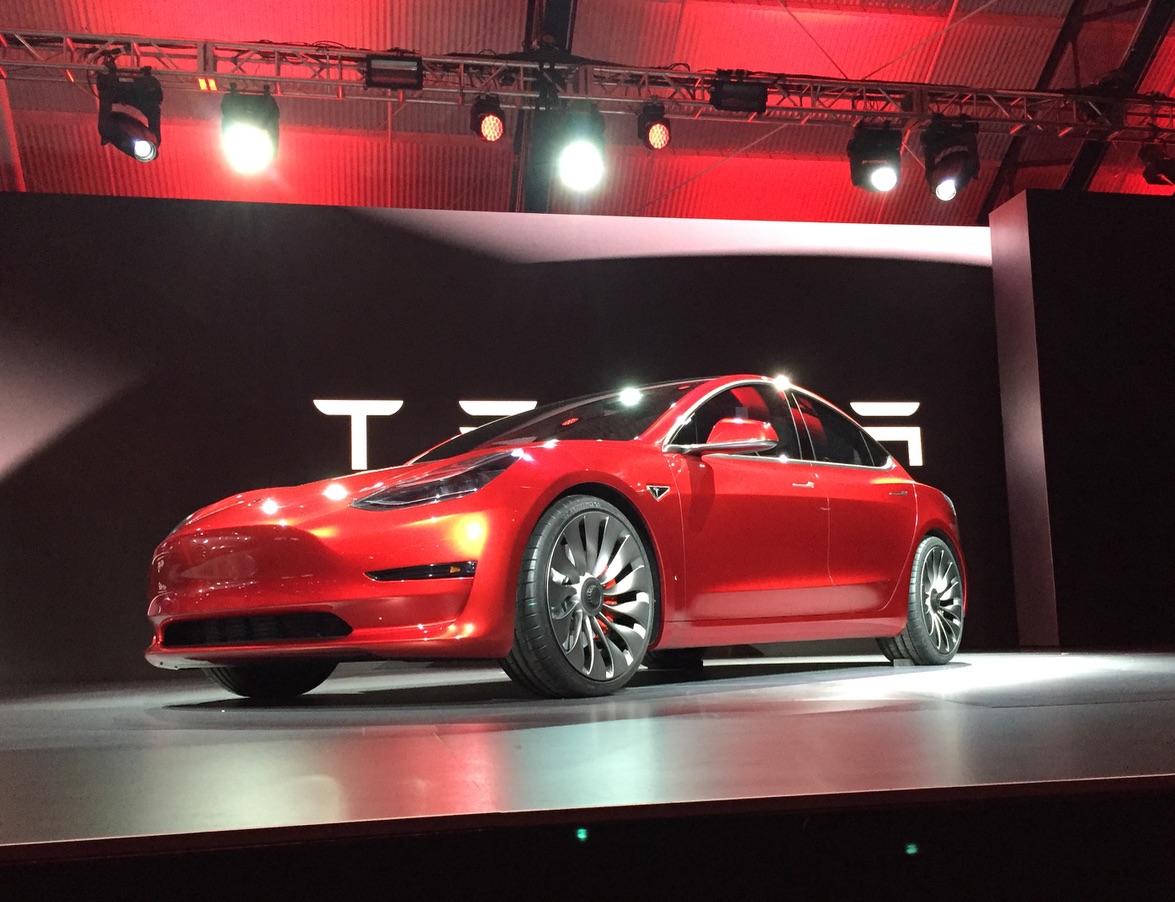

The new Tesla Model 3 is only $35K? That’s at least what their advertising would like you to believe. It’s only a “bit more” expensive than your last vehicle purchase. Maybe it’s finally time to get on that; you’ll save so much money on gas too!

The new Tesla Model 3 is only $35K? That’s at least what their advertising would like you to believe. It’s only a “bit more” expensive than your last vehicle purchase. Maybe it’s finally time to get on that; you’ll save so much money on gas too!

By the end of 2011, I had completed nine years of real estate investment courses. Acquisition, cashflow, buy & hold, flipping, landlording, rent to own, taxation law… the list goes on and on.

By the end of 2011, I had completed nine years of real estate investment courses. Acquisition, cashflow, buy & hold, flipping, landlording, rent to own, taxation law… the list goes on and on.